The Donut Hole: A Step-By-Step Explanation

What is the Donut Hole?

The Medicare Part D Donut Hole, or Coverage Gap, is one of four stages you may encounter during the year while a member of a Part D prescription drug plan. Specifically, the Donut Hole is the point in the year when your prescription benefits change because the total cost paid by you and the plan have reached the Initial Coverage Limit. If you enter the Donut Hole, you may have to pay a higher price for your medications until the next January 1, or until your out-of-pocket costs qualify you for another level of insurance called Catastrophic Coverage.

The Four Coverage Stages

1 Deductible Stage

A prescription drug deductible is the amount you pay for drugs before we begin to pay our share.

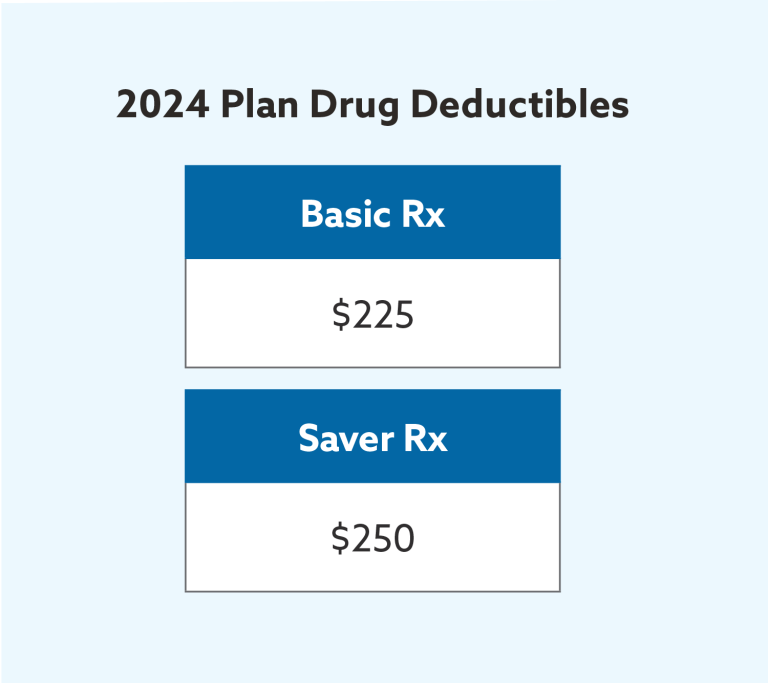

Members of Tufts Medicare Preferred HMO Saver Rx and Basic Rx plans have a Part D (prescription drug) deductible for drugs on Tier 3, Tier 4, and/or Tier 5.

The deductible counts toward any combination of drugs on Tiers 3, 4, and 5. You will not pay a separate deductible for each tier. After you pay the deductible, you will pay only your copay for Tier 3, 4, and 5 drugs.

All other plans do not have a Part D deductible.

2 Initial Coverage Stage

Most members with a Part D prescription drug plan will start in the Initial Coverage stage. (If you are a member of Tufts Medicare Preferred HMO Saver Rx or Basic Rx plan, see the Deductible stage section above for information on your Part D deductible.)

- The Initial Coverage stage ends when the total cost of your drugs (your copay PLUS the amount that Tufts Health Plan pays for your drug) reaches $5,030.

- After you reach a total of $5,030, you enter the Coverage Gap stage, also known as the Donut Hole.

3The Donut Hole (Coverage Gap Stage)

![DonutHoleGraphics[2024][resize]-01](/sites/default/files/styles/editor_full/public/2024-01/DonutHoleGraphics%5B2024%5D%5Bresize%5D-03_0.png?itok=hcLiyTdc)

While in this stage, you are responsible for:

- 25%* of the cost of generic (non-brand name) Part D medications. Tufts Health Plan pays the remaining 75% of the cost.

- 25% of the cost of Part D brand name medications. The drug manufacturer pays 70% of the cost of Part D brand name medications and Tufts Health Plan pays the remaining 5%. The entire cost of the Part D brand name drug, minus the 5% that Tufts Health Plan is responsible for, goes toward your out-of-pocket maximum of $8,000.

- $0 for Tier 6 Vaccine drugs, including all covered brand and generic vaccines.

- $35 for a 30-day supply of covered insulin drugs.

Once your total out-of-pocket costs reach the maximum of $8,000, you enter the Catastrophic Coverage stage.

*If you are a member of HMO Prime Rx Plus plan, you pay your Tier 1 and Tier 2 copays for Tiers 1 and 2, 25% of the cost for all other generic drugs, and 25% of the cost for brand name medications.

4 Catastrophic Coverage Stage

You enter the Catastrophic Coverage stage when your total out-of-pocket costs (what you pay PLUS what the drug manufacturer pays) reach $8,000. While in Catastrophic Coverage, you pay nothing for covered Part D drugs and for excluded drugs that are covered under our enhanced benefit.

You will remain in the Catastrophic Coverage Stage until January 1. This process resets every January 1.

Need an easy way to reference the Donut Hole?

Use this handy Donut Hole summary sheet: Understanding the Medicare Donut Hole (PDF)

Help is available if you are in the Donut Hole or are getting close to it.

There are many resources available to individuals who reach, or at risk of reaching, the gap:

- Prescription Advantage: An income-based assistance program for Massachusetts residents that may help you pay for your prescription drugs once you are in the Donut Hole. Your income level will determine the level of assistance you are granted. For more information call 1-800-AGE-INFO (1-800-243-4636) TTY 1-877-610-0241, press option 2, or visit www.mass.gov/prescription-drug-assistance.

- Low Income Subsidy (LIS), or Extra Help: LIS is an income-based assistance program run by the Social Security Administration. If you qualify, you may receive help paying for your monthly premium and prescription drug copays. For more information, contact Medicare at 1-800-633-4227 (TTY 1-877-486-2048), the Social Security Office at 1-800-772-1213 (TTY 1-800-325-0778), or the Office of Medicaid for the Commonwealth of Massachusetts at 1-617-573-1770.

- Pharmaceutical Company Prescription Assistance Programs: You may also qualify for help with the cost of certain medications through prescription assistance programs offered by the drug manufacturer. Every drug manufacturer has certain criteria that you must meet in order to qualify for help. If you need assistance, contact Member Services.